A RECIPE FOR RECESSION …

In the past, we have been critical of Alexandria Ocasio-Cortez (AOC) for her economic ignorance. We’ve also criticized Fed Chairman Powell for his hawkish monetary policy. But to be fair, we also need to give them credit when it’s due.

Federal Reserve Chairman Jerome Powell testified today before the House Committee on Financial Services. During AOC’s questioning of the chairman (click on YouTube video link here), she accurately portrayed the Fed’s abject failure in forecasting the natural rate of unemployment, i.e. the lowest unemployment rate whereby inflation is stable or the unemployment rate that exists with non-accelerating inflation.

AOC was right to recount how the Fed grossly underestimated the natural rate of unemployment. In early 2014, they thought it was 5.4%. Today the unemployment rate is 3.7%, with inflation still under the Fed’s goal of 2%.

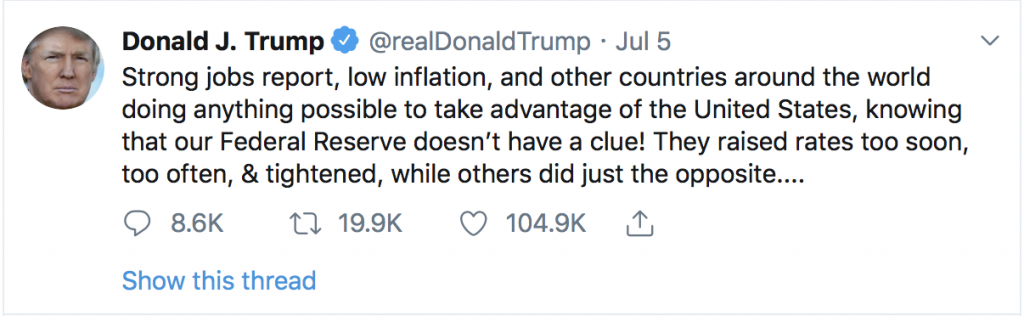

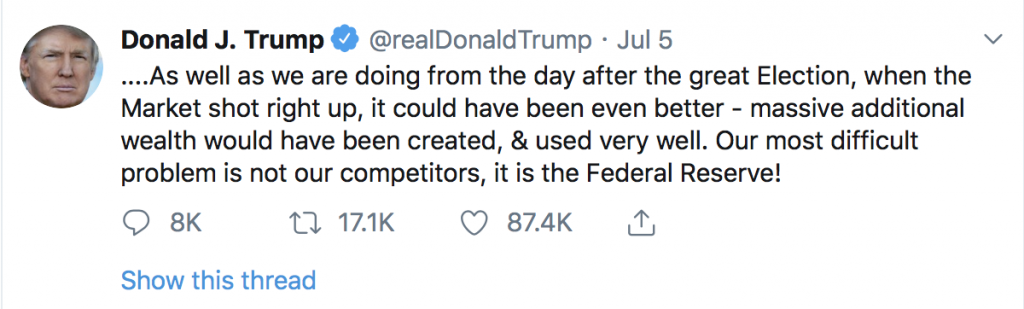

As President Trump has complained, that egregious Fed forecast led to even more costly Fed mistakes — raising interest rates too soon, tightening the money supply too much, ignoring foreign central bank actions that reduced their country’s currency value — all of which resulted in missed opportunities for even better growth, greater trade, more jobs and higher wages than the record economic achievements we’re currently experiencing.

Unfortunately, we can’t completely endorse AOC’s performance today. Her main (and selfish) objective in highlighting the Fed’s errors in forecasting unemployment and inflation was to argue for more aggressive fiscal policy (i.e., more government spending), rather than looser monetary policy (i.e., lower interest rates). AOC’s logic: Since unemployment and inflation have decoupled, and the Fed has underestimated how low unemployment can go, perhaps there’s room for even greater government spending before runaway inflation would occur. We understand why AOC pursued that line of questioning. She wanted the Fed Chairman’s concurrence that spending $100 trillion on her Green New Deal wouldn’t adversely impact the economy. Nice try, AOC, but Chairman Powell didn’t bite. He correctly stated that more aggressive government spending (not to mention trillion dollar increases) would only be warranted in the event of a severe recession. So we give credit to Chairman Powell for providing AOC with sound economic advice.

But despite our good natured compliments, both AOC and Chairman Powell are leading the economy down a dangerous path. If AOC has her way and goes on a socialist spending spree with higher taxes for everyone, and if Chairman Powell doesn’t reverse the Fed’s monetary drag on growth and currency handicap in foreign trade, the U.S. economy won’t achieve its full potential and might even be headed for that severe recession.