BENEFITTING AMERICAN SUPPLIERS, WORKERS AND INVESTORS …

One of the predicted benefits of the Republican-backed Tax Cuts and Jobs Act (TCJA) that went into effect in January 2018 was the repatriation of U.S. foreign profits and the resulting additional tax receipts.

As described by the Wall Street Journal, “Before 2018, the U.S. generally taxed foreign profits only as companies transferred them to a U.S. parent. Profits indefinitely reinvested overseas, or simply held as cash or securities by foreign subsidiaries, could avoid the levy. The TCJA ended that practice, instead imposing a one-time “repatriation” tax on accumulated foreign profits and greatly reducing taxes on new foreign profits. That sharply reduced the additional cost of repatriating foreign funds.”

The one-time “repatriation” tax is 15.5% on liquid assets, such as cash and a variety of marketable securities, and 8% on illiquid assets such as plant and property. The government estimates that the “repatriation” tax on an estimated $2.5 trillion or more of accumulated foreign profits will generate $339 billion in tax receipts over the next decade.

So after 1.25 years of TCJA implementation, what are the foreign profit repatriation and tax receipt numbers?

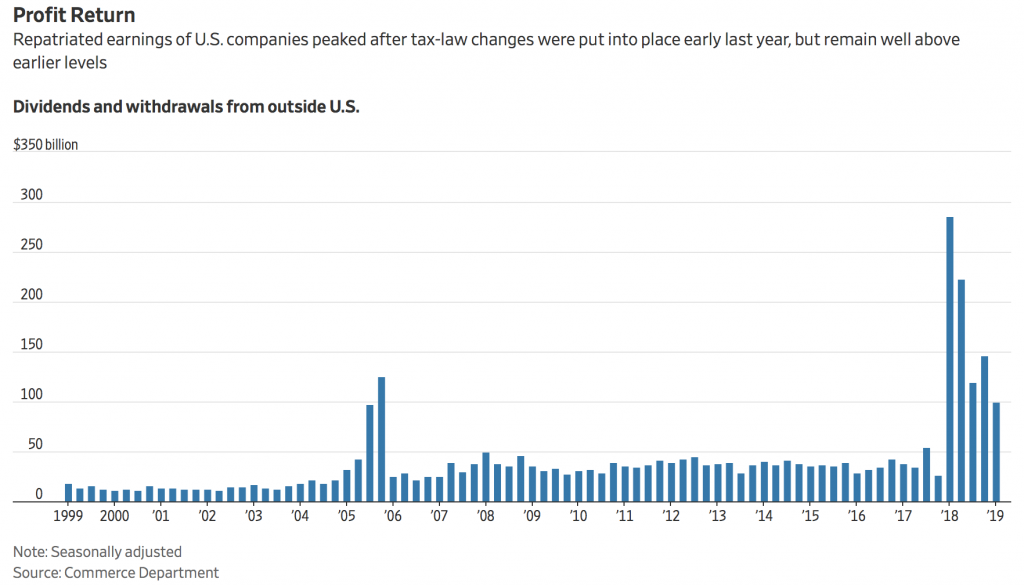

As you can see in the figures and graph below, U.S. companies have repatriated a total of $876.75 billion of foreign profits over the past five quarters:

1Q18: $285.88 billion

2Q18: $223.79 billion

3Q18: $120.23 billion

4Q18: $146.60 billion

1Q19: $100.25 billion

TOTAL: $876.75 billion

Though repatriated profits were declining to $100 billion in 1Q19, that is still more than double the average quarterly amount for the past 20 years.

Using the government’s method for calculating tax receipts on repatriated earnings ($339b / $2.5 trillion = 13.56%), tax receipts for the first five quarters of repatriated earnings is approximately $876.75 billion x 13.56% = $119 billion … or 35% of the $339 billion estimate for the next decade in just the first five quarters of implementation.

In addition to new tax receipts, there are other benefits of increased foreign profit repatriation. After companies pay their repatriation tax, they can spend the remaining foreign cash in various ways: investment, paying down debt, creating jobs, increasing wages, paying wage bonuses, paying dividends, and/or repurchasing shares. All excellent outcomes for suppliers, workers and investors.

As promised, the Republican-backed TCJA is bringing U.S. foreign profits home to the benefit of the American people.