TO LEVEL GLOBAL PLAYING FIELD, ALIGN WITH ACTUAL INFLATION, ACCELERATE GROWTH & EMPLOYMENT, AND AVOID RECESSION …

Please indulge us as we try one more time to convince the Federal Reserve Bank to lower the fed funds interest rate at their next meeting this month.

We provide the following new ammunition to justify our repeated call for easier monetary policy to sustain the expansion, maximize employment and moderate inflation …

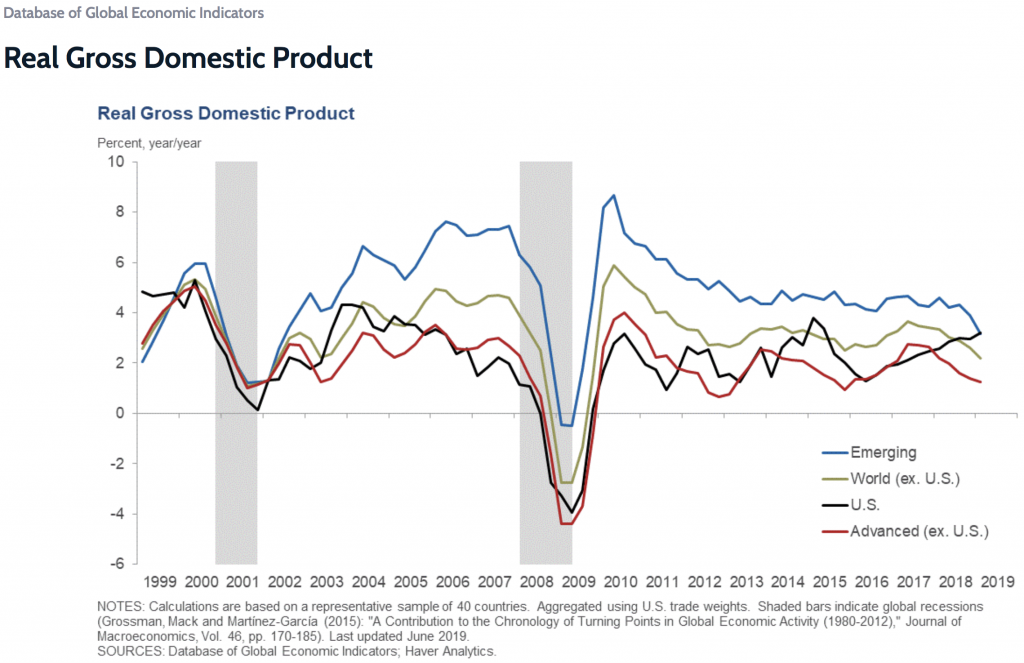

STAGNATING GLOBAL GROWTH

While U.S. GDP is currently the envy of the world, nearly every other region is experiencing either stagnation or slowing. Eventually, despite strong American consumer spending, a decline in worldwide demand for American products and services will undoubtedly hurt our economy.

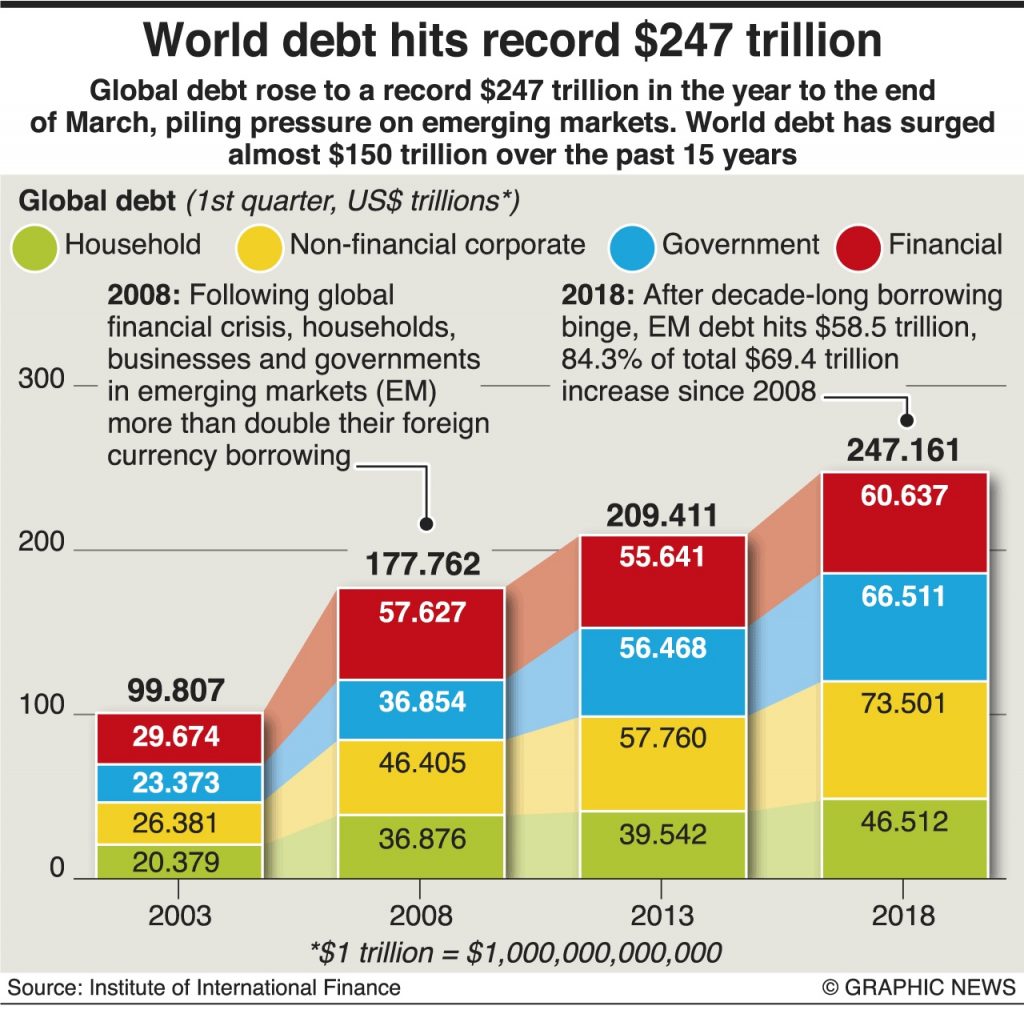

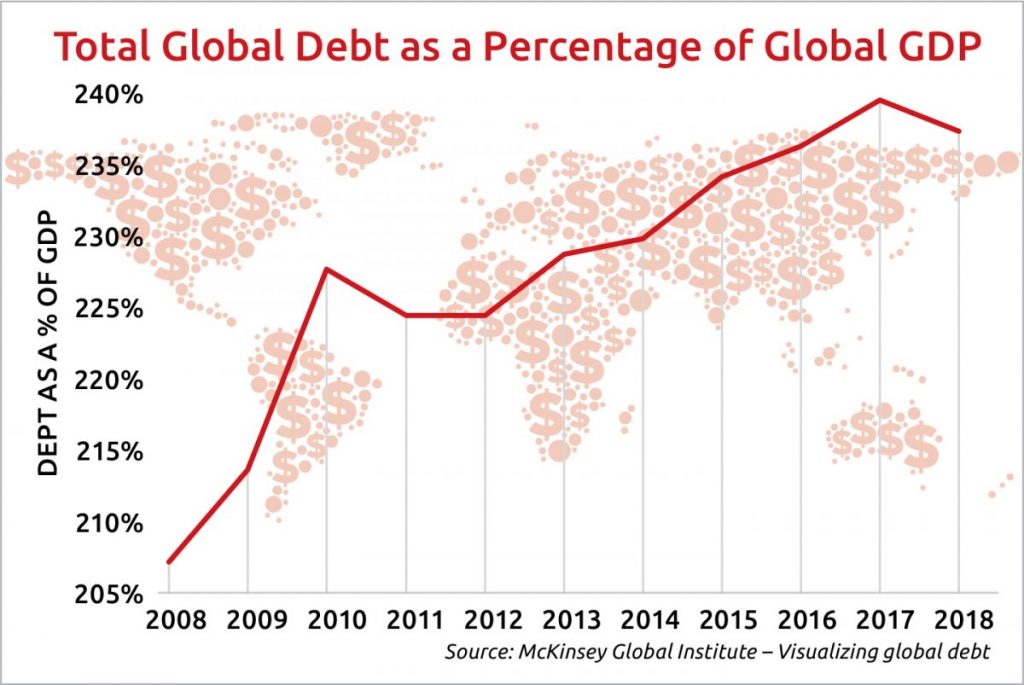

RECORD GLOBAL DEBT RAISES INTEREST SERVICE, PUTTING PRESSURE ON GROWTH

As reported in the Wall Street Journal, “There are longer-term drivers bearing down on the Fed’s policy rate. These include global factors like the level of debt, demographics, and distribution of wealth, disruptive technologies, etc. The single most important factor is debt. We believe the increase in global debt levels, across private and public sectors, will lower future growth through the debt-servicing channel.”

In most major economies, debt has been growing at a faster rate than their underlying GDP.

RECESSION WARNING SIGNS

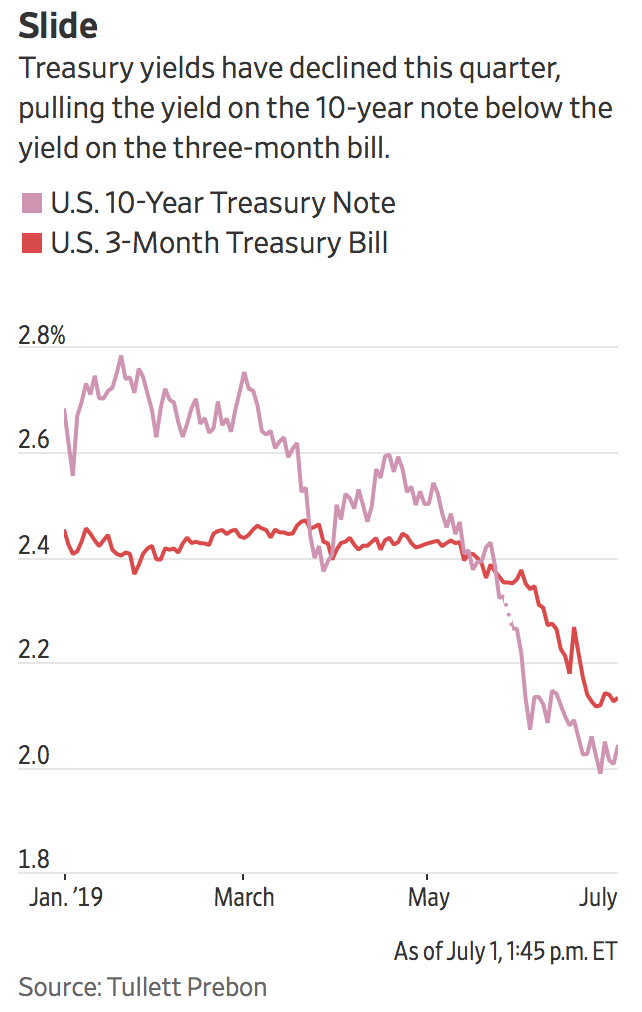

The 10-year treasury yield has been below the 3-month treasury yield for more than a month now.

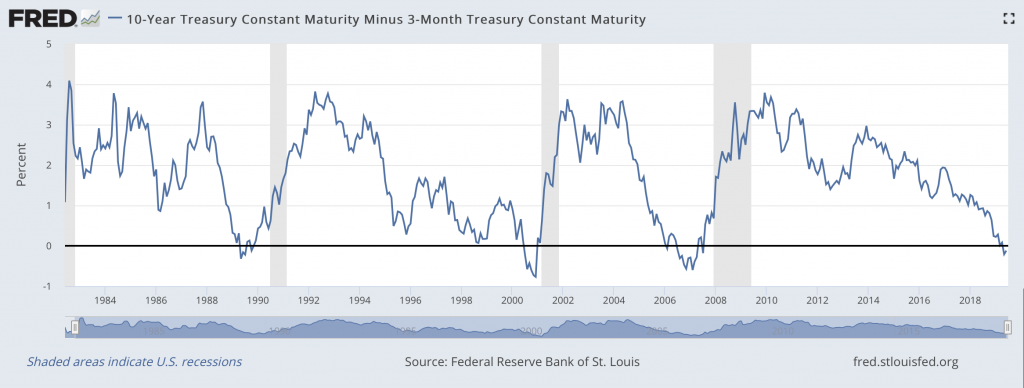

Historically, a recession is imminent whenever the 10-year treasury yield minus the 3-month treasury yield goes below zero for a sustained period of time. The current inverted yield curve has been in effect since May 23, 2019.

Tom Barkin, president of the Federal Reserve Bank of Richmond, warned in a Wall Street Journal interview printed on July 2 that when businesses are pessimistic enough about growth prospects, their worries about a recession can become a self-fulfilling prophecy. He says, “In such a cycle, cutbacks in business investment prompt cutbacks in employment, which leads to cutbacks in consumer spending, and that’s how the economy starts to head south.”

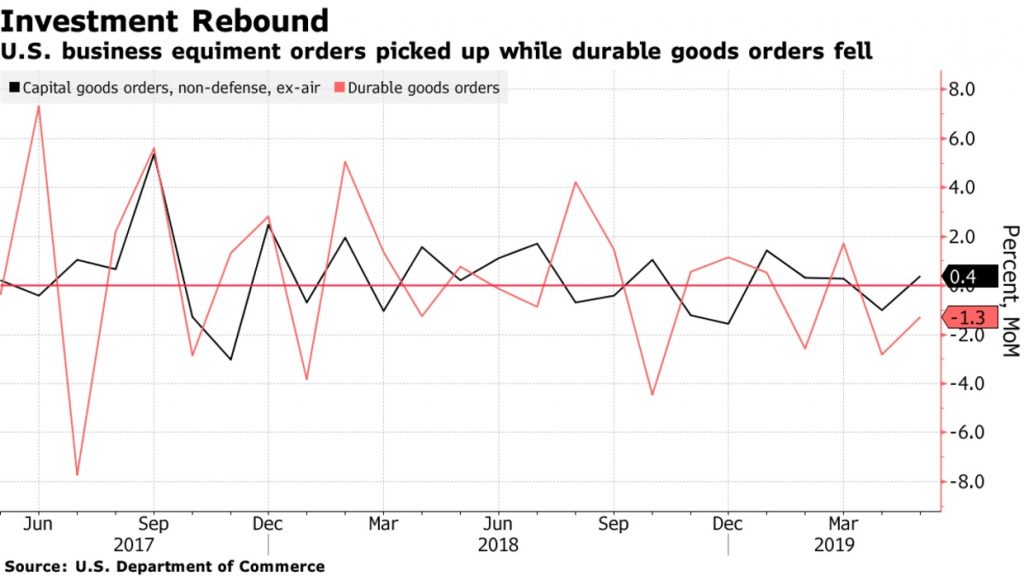

Those business investment and confidence warning signs are already appearing …

As reported by Bloomberg on June 26, the modest pickup in equipment and durable goods orders in May might have briefly eased concerns that trade conflicts are weighing on manufacturers and complicating business investment, but there’s no doubt that factory conditions have cooled relative to 2018.

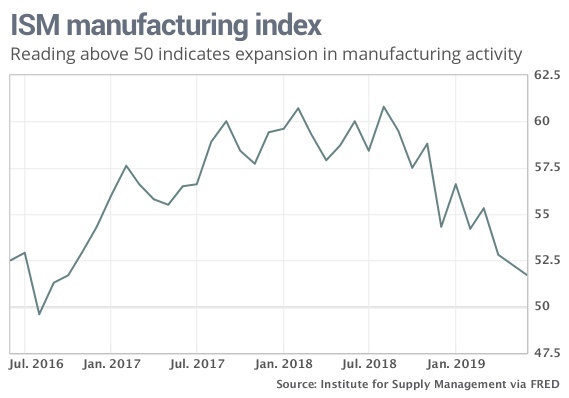

And as reported in MarketWatch on July 1, ISI’s most recent survey of business executives found that manufacturers grew at the slowest pace since late 2016, hurt by trade tensions and weak exports.

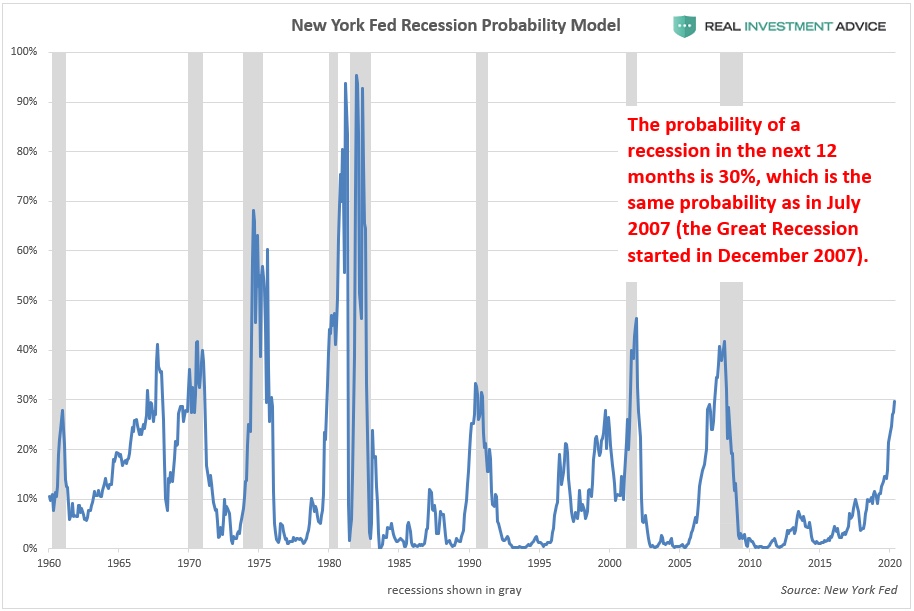

Finally, the Fed’s own forecast now pegs the probability of a recession occurring in the next 12 months at 30%.

GLOBAL CENTRAL BANKS ARE USING LOWER INTEREST RATES AND QUANTITATIVE EASING TO SPUR GROWTH AND AVOID RECESSION

As reported by Citi, global central banks have responded to slowing global growth and rising trade tensions with “do whatever it takes” monetary policies to avoid a recession:

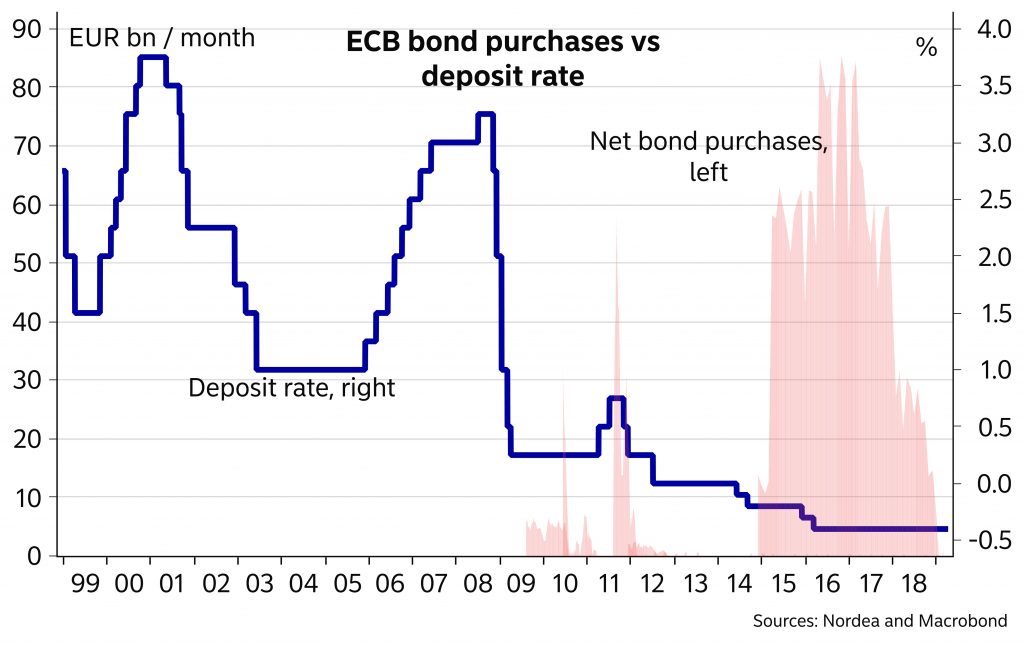

The European Central Bank (ECB) has reduced interest rates below 0% and may resume bond purchases (i.e., quantitative easing).

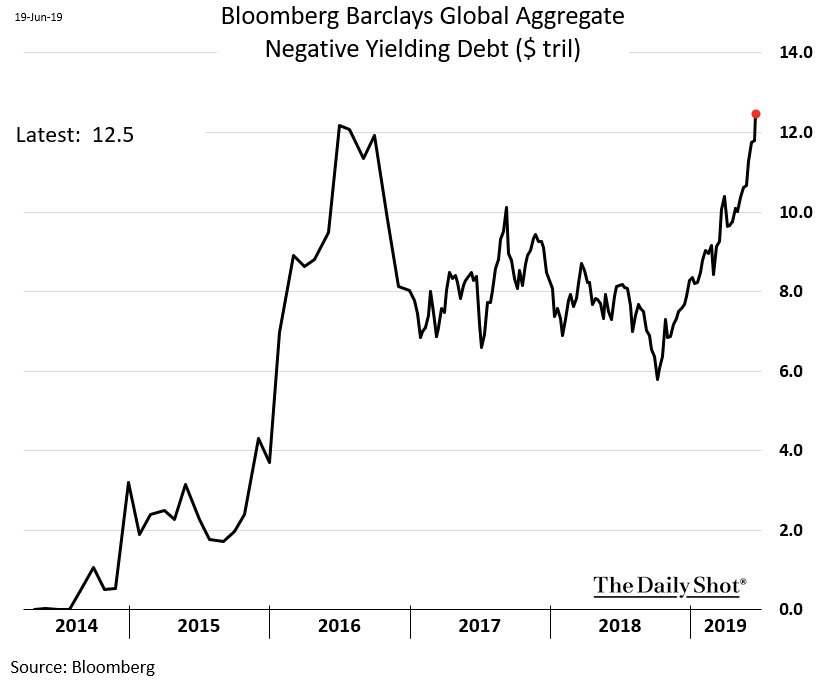

Government bonds all over Europe are yielding less than zero. In Germany, the Netherlands and Denmark even 10-year bond yields are in negative territory.

A record $12.5 trillion in world bonds currently trade at negative yielding rates.

The Bank of Japan (BoJ) has reduced interest rates below 0% while tapering bond purchases.

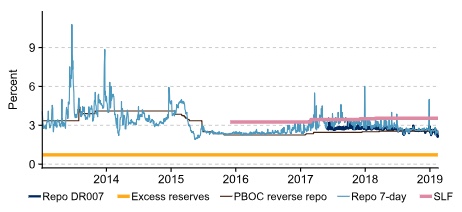

Despite China’s >6% GDP growth, the People’s Bank of China (PBoC) maintains a relatively low (<3%) seven-day repurchase (repo) rate for depositary institutions (DR007). This is the rate at which banks lend to each other over periods of seven days, similar to the U.S. fed funds rate.

Source: People’s Bank of China, CEIC, and S&P Global Economics.

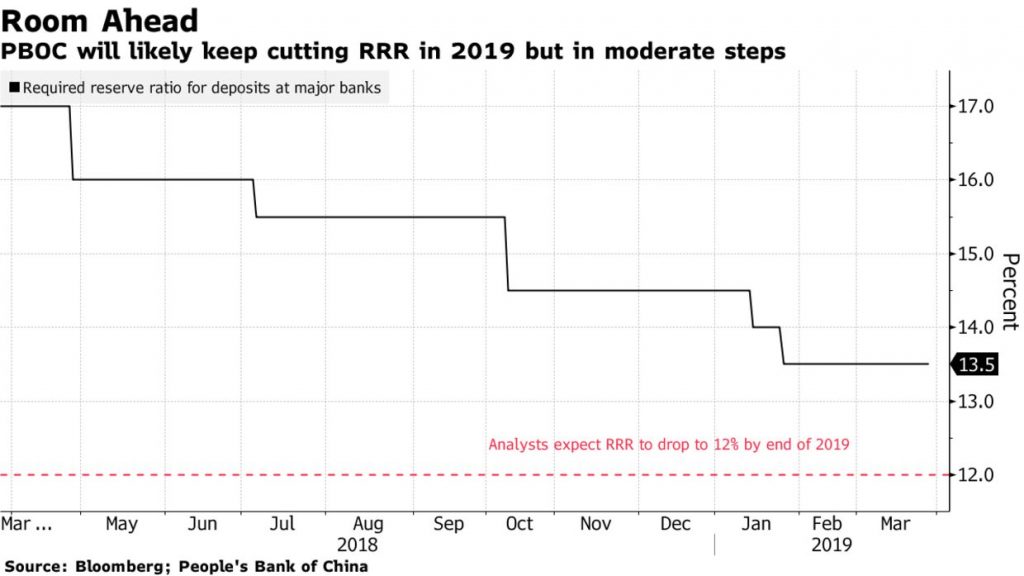

PBoC will also continue lowering their required reserve ratio (RRR) requirements – the amount of money lenders have to put aside as reserves – which is a liquidity enhancing form of quantitative easing.

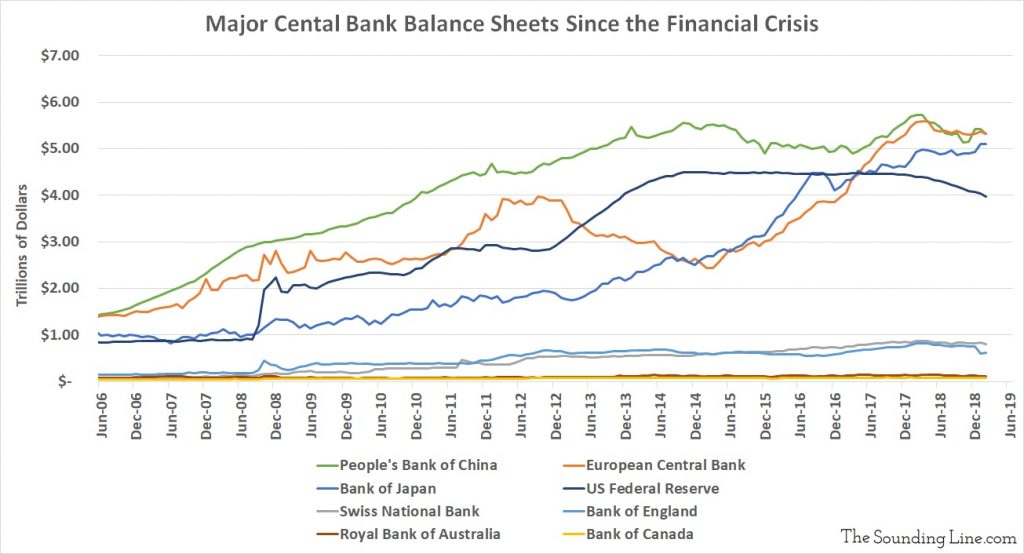

As written in The Sounding Line, there is very little room for global central banks to continue cutting short-term interest rates, but they plan to employ various forms of quantitative easing to prevent the next recession. (QE effectively pushes down long-term interest rates.)

FED INFLATION AND FUNDS FORECASTS ARE FLAWED

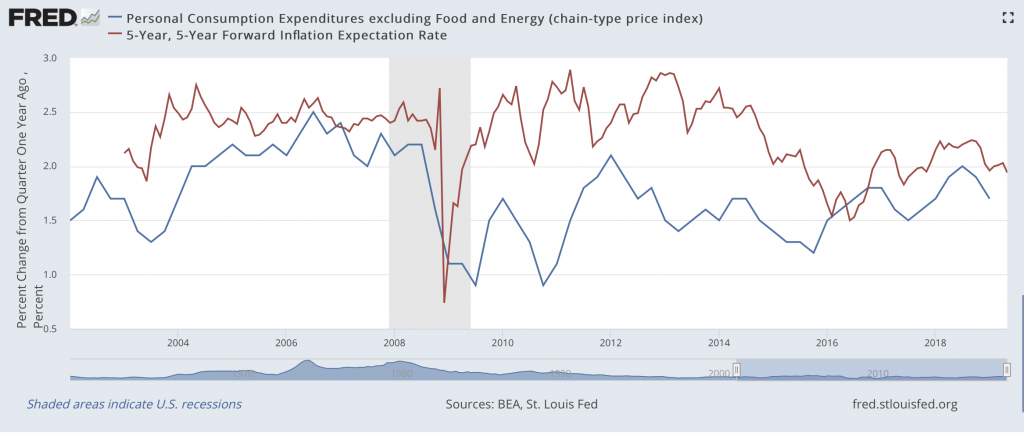

As evidenced in the graph below, for most of the past 16 years, the Federal Reserve’s inflation forecasts have exceeded their preferred measure for determining actual inflation, the Personal Consumption Expenditures (PCE) price index.

In March, former Fed Chief Alan Greenspan told attendees at a Wharton Business School discussion that the Fed has a “problem measuring inflation.”

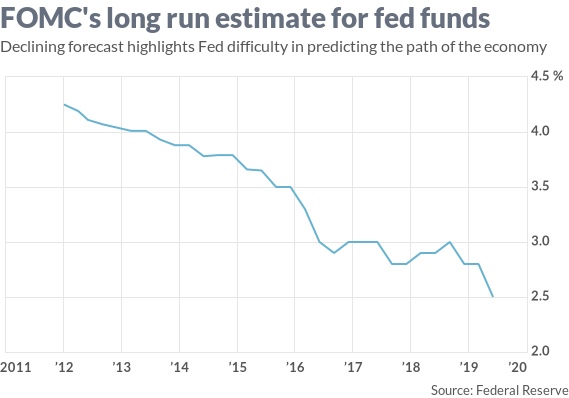

The Federal Reserve has also made repeated errors in estimating the proper level for the fed funds rate, a key interest rate that influences U.S. borrowing costs.

As reported in MarketWatch, “Just seven months ago, central bank honchos were penciling in two increases in the Fed’s benchmark interest rate in 2019 and another one in 2020. The fed funds rate was supposed to top out at around 3.1%. By March, the Fed had ruled out any rate increases in 2019, leaving fed funds around 2.4%. And now the bank is predicting a possible rate cut later this year.”

CONCLUSIONS

The Fed’s reluctance to acknowledge recession warning signs and their inflation forecasting miscalculations have resulted in an inefficacious monetary policy that keeps interest rates unnecessarily high, suppressing maximum potential for U.S. growth and employment.

The Fed needs to compete with other central banks’ monetary policy and currency deflation actions to ensure a level playing field in the global economy for American businesses, workers and consumers.

The Fed must “re-anchor” inflation expectations to the PCE price index, tackle stagnant global growth and reverse the inverted yield curve by lowering the federal funds rate at least 25 to 50 basis points in July.