FEDERAL RECEIPTS GREW IN FISCAL YEARS 2018 & 2019 …

The Tax Cuts and Jobs Act (TCJA) was signed by President Trump into law on December 22, 2017, and most of the changes in the bill went into effect on January 1, 2018.

Democrats unanimously opposed the TCJA. Not one single Democrat in either the House or Senate voted in favor of the bill. Only 12 Republicans in the House voted against it.

Major elements of the new tax law included reducing rates for businesses and individuals; a personal tax simplification by increasing the standard deduction and family tax credits, but eliminating personal exemptions and making it less beneficial to itemize deductions; limiting deductions for state and local income taxes (SALT) and property taxes; further limiting the mortgage interest deduction; reducing the alternative minimum tax for individuals and eliminating it for corporations; reducing the number of estates impacted by the estate tax; and repealing the individual mandate of the Affordable Care Act.

Now that the TCJA has been implemented for nearly two fiscal years, has it benefitted the American people?

The answer can be found in these 2018 highlights courtesy of the U.S. Department of Treasury:

- According to the non-partisan Tax Policy Center, about 80% of American taxpayers or more than 140 million American families saw their federal taxes decline because of the TCJA.

- H&R Block says their clients saw their taxes decline by 24.9% on average.

- A typical family earning $75,000 saw their total taxes fall to just $1,739, a tax reduction of $2,244 per family.

- During 2018, real GDP increased by 3.1 percent measured from the fourth quarter of 2017 to the fourth quarter of 2018. This is the highest Q4 to Q4 growth rate since 2005.

- Workforce participation among prime-age workers stands near its highest level in almost a decade, the unemployment rate is at its lowest in 50 years, minority unemployment rates are at record lows, and for the first time since at least 2001, there are more job openings than Americans looking for work.

- Americans saw large wage gains in 2018 as a result of the stimulus to economic activity generated by the TCJA, combined with the Trump administration’s deregulatory activities of the past two years.

- Americans’ retirement accounts and education savings accounts are also benefiting from the improved economic environment. Since Election Day 2016, holdings in US equity markets haveincreased by over 35%.

But remember all of the dire predictions by Democrats, left-wing political organizations and the mainstream media that the TCJA would drastically reduce federal revenues and never pay for itself? If you don’t recall, here’s a reminder:

Nancy Pelosi, 11/30/17: “This tax scam (is a) rip-off, this plundering, this pillaging of the middle class that the Republicans are doing. Their trickle-down economics has always been in their DNA. It has never created jobs, it has always increased the deficit, and it’s simply not true that it pays for itself.”

House Democrats, 12/15/17: “Under their repeatedly disproven “supply side” theory, they (Republicans) claim these tax cuts will spur so much new economic activity that the new revenues generated will offset most or all of the direct revenue loss caused by the tax cuts.”

Chuck Schumer, 12/1/17: “In my long career in politics, I have not seen a more regressive piece of legislation, so devoid of a rationale, so ill-suited for the condition of the country, so removed from the reality of what the American people need. Working people in our country are struggling. Corporations and the very wealthy are doing great. There is no reason for rushing through a tax break for millionaires and billionaires, paid for by pilfering the pockets and the healthcare of middle-class Americans. Millions of middle class families will get a tax hike next year, and millions more thereafter because of this bill. That’s why the bill is such a monstrosity and such a danger to the country.”

Bernie Sanders, 12/1/17: “This tax bill will be remembered as one of the greatest robberies in American history because the federal treasury is being looted.”

Brookings Institute, 11/7/17: Tax Cut Proponents Ignore That There’s No Free Lunch … “When the economy, as now, is bumping against maximum capacity, tax cuts have never paid for themselves, or even close to it. And there is no reason to think that the Republican plan, released by House Republicans on November 2, will do so either.”

CNN, 11/2/17: The Ominous Absurdity of Trump’s Tax Cuts … “President Trump and the Republican leadership in Congress assert that corporate tax cuts would boost growth and thereby pay for themselves, the same voodoo they’ve endlessly peddled.”

For the record, the Trump administration’s position was never that the tax cuts alone would pay for themselves. Their position was that “President Trump’s economic program — additional growth from tax cuts, deregulation, infrastructure spending, etc. — will generate revenues that more than offset the cost of the tax cuts.”

So how’s the TCJA doing on that federal revenue metric?

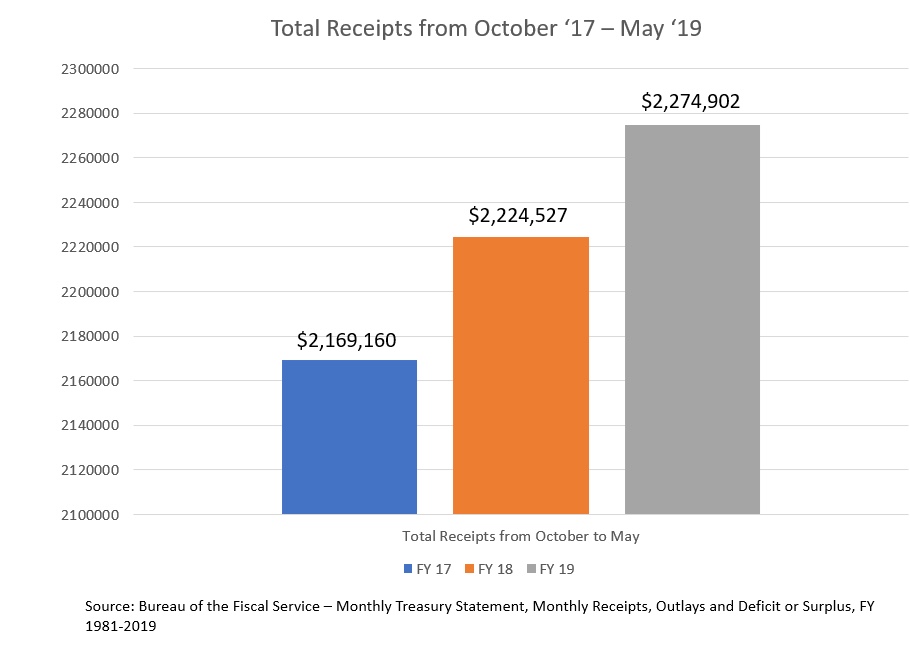

Last week, the Department of Treasury released new data for April and May receipts in Fiscal Year 2019. As you can see from the chart below, Treasury receipts are up in both FY2018 and FY2019.

The proof is in: Tax cuts and deregulation spur growth in GDP, jobs and wages, leading to higher federal tax receipts … which facilitates Government financial support of important but rapidly growing social health and welfare programs.

Going forward, to further enhance growth and reduce the budget deficit, Republicans will propose additional tax reductions and deregulation, new infrastructure investments, and entitlement reforms.

One would hope that Democrats running in the 2020 presidential election would learn from their party’s failed economic policies, predictions and scare tactics, but no such luck. The leading Democratic contenders — Biden, Warren and Harris — have all vowed to repeal the Tax Cuts and Jobs Act. Demonstrating their complete detachment from tax reform reality and fiscal responsibility, Democrats also plan to raise your taxes and children’s debt to finance trillions of dollars of additional spending on socialist programs like the Green New Deal, Medicare For All, Tuition-Free Education and Guaranteed Jobs.

Getty Images

You have a choice in November 2020 … Which party was right on tax reform and which party gives you the most confidence in their ability to deliver what’s best for America — a growing economy, sustainable social programs, and limited government control of your daily life?