FOR UNFETTERED GROWTH AND PROTECTION AGAINST GLOBAL ECONOMIC SLOWDOWN, TARIFF / TRADE WARS AND POTENTIAL RECESSION …

We support the Trump economic advisors’ (economists Art Laffer and Stephen Moore) call for the Federal Reserve Bank (Fed) to lower short-term interest rates.

(Source: CNBC)

Why? There are three primary reasons …

EMPLOYMENT STILL HAS ROOM TO GROW

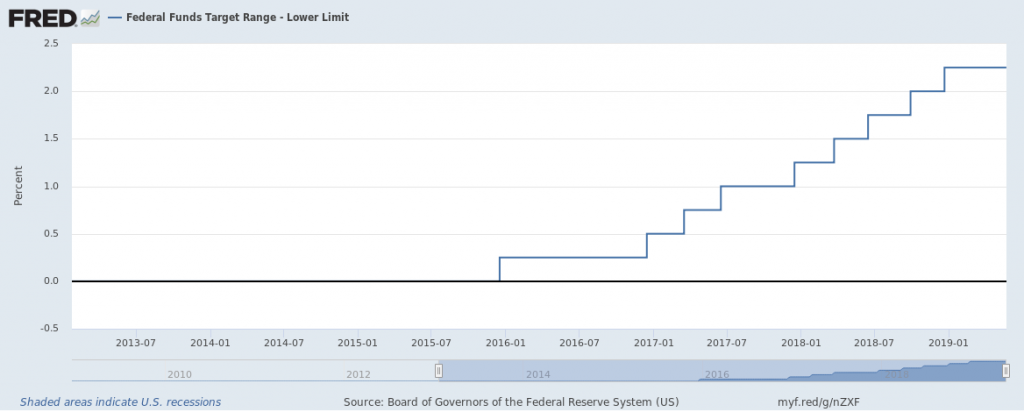

The Fed’s dual mandate is to control inflation and maximize employment. It uses higher interest rates to prevent the economy from overheating and lower rates to stimulate growth. So let’s take a look at what the Fed has been doing with interest rates during Obama’s last four-year term and Trump’s first two years.

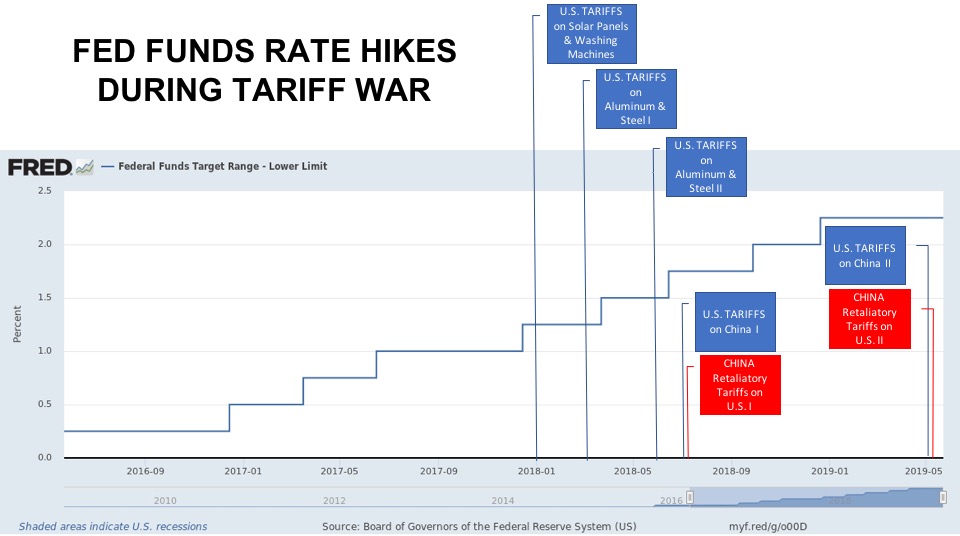

During the last year of Obama’s eight-year term, the Fed raised short term interest rates from 0% to 0.5%. Since Trump’s inauguration in January 2017, the Fed has raised rates seven more times, from 0.5% to 2.25%.

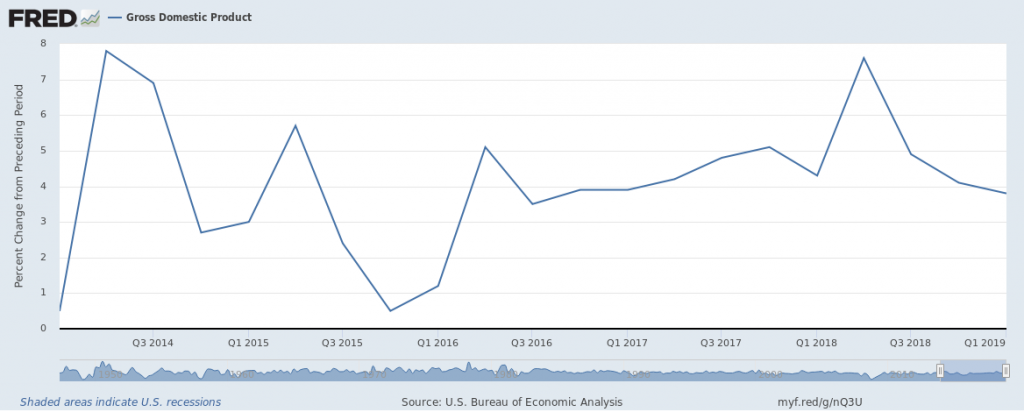

But even though GDP responded well to Trump’s tax cuts and deregulation, it isn’t growing at a breakneck pace.

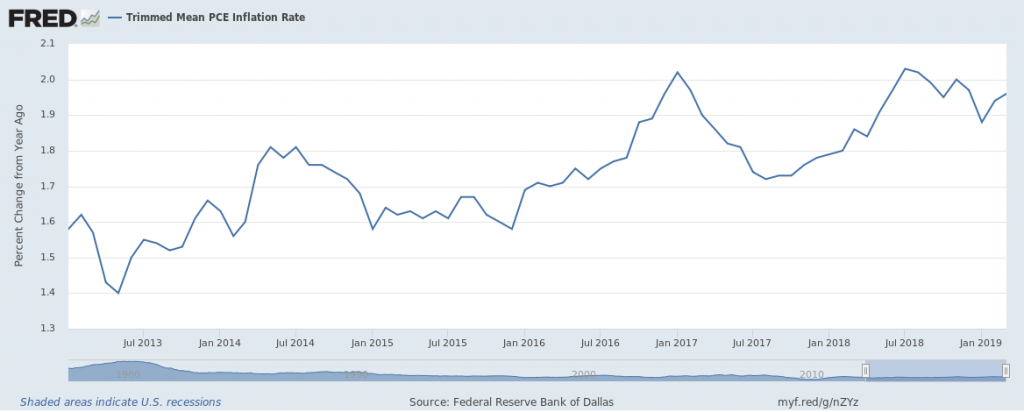

And the Fed’s favorite tool for measuring core inflation — Personal Consumption Expenditures (PCE) — has remained tame and is currently below the Fed’s 2% target rate.

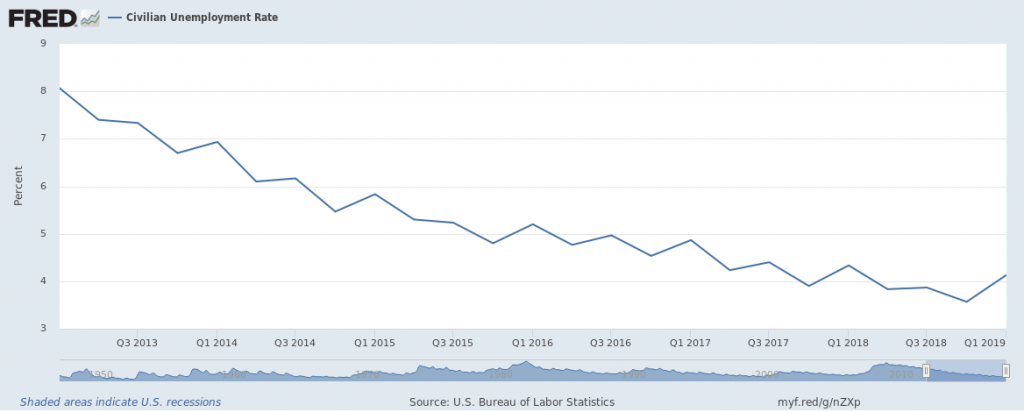

Meanwhile, unemployment continues declining.

So if unemployment hasn’t bottomed out yet and inflation still hasn’t met the Fed’s target, then the Fed should reduce rates to allow the economy to grow unfettered and maximize employment.

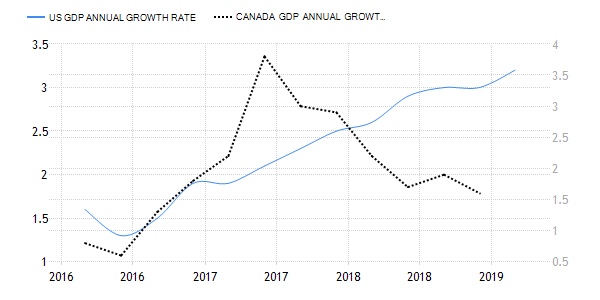

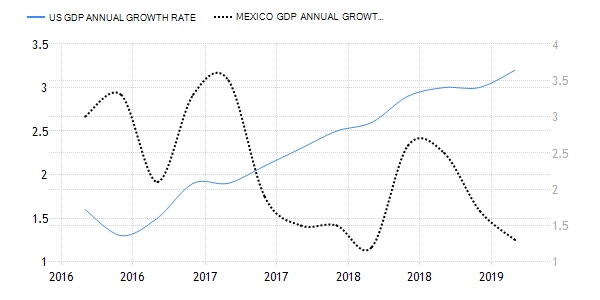

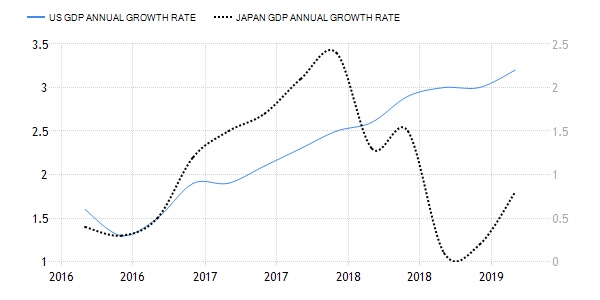

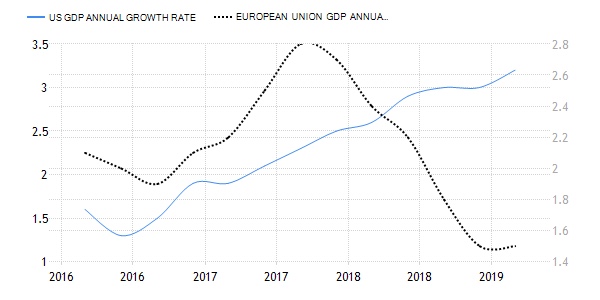

GLOBAL ECONOMIC SLOWDOWN AND TARIFF WARS CANNOT BE IGNORED

The U.S. economy is hot due to rising domestic business earnings, consumer consumption and worker wages, but the rest of the world is experiencing an economic slowdown. The Fed must take into consideration the weakening draw from our largest trading partners — China, Canada, Mexico, Japan and European Union — when deciding its fed funds rate.

During this time of U.S. economic strength, the Trump Administration is pursuing long overdue action to address illegal, unfair and nonreciprocal trade practices by some of our major trading partners. The Fed seems oblivious to the potential temporary economic side effects this tariff war might have on our economy, instead raising rates throughout the implementation and retaliation of tariffs.

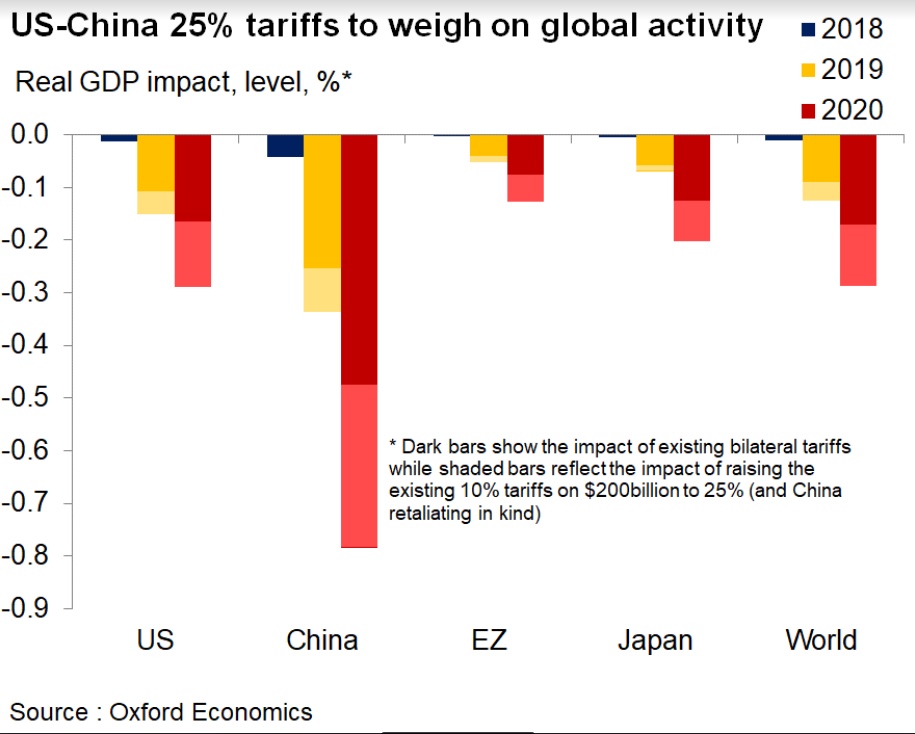

According to Gregory Daco, chief U.S. economist at Oxford Economics, “The latest move to hike tariffs to 25% from 10% on half of U.S. imports from China — with China raising 8% tariffs on $60 billion of U.S. imports to 25% — would reduce U.S. gross domestic product by 0.3% in 2020, while curbing China’s output by 0.8%. That translates to a cost to the U.S. economy of around $62 billion in lost output by 2020 relative to the expected level of GDP in the firm’s baseline forecasts, and a hit to the global economy of 0.3% or more than $360 billion.”

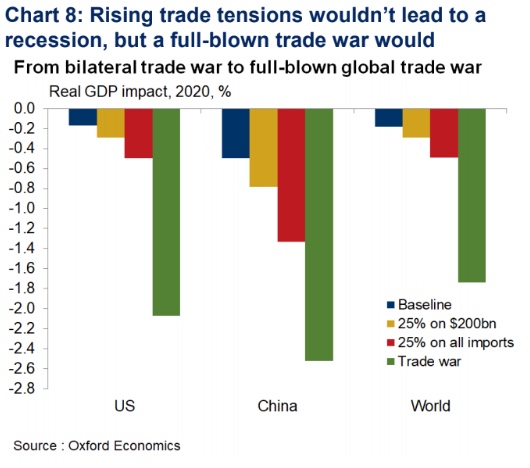

“In a scenario where Washington puts tariffs of 25% on all imports from China, with Beijing retaliating in kind, U.S. GDP would take a hit of around 0.5%. That would push real GDP growth — growth minus inflation — dangerously close to 1% by the end of 2020,” says Daco.

Considering a tariff war could turn into an all out trade war, and inflict serious damage to growth, the Fed should aid the Trump Administration’s necessary fight against unfair trade practices by loosening the money supply until the outcome of all trade negotiations is known.

FOLLOW THE BOND MARKET

As Art Laffer recommends, “Federal Reserve Chairman Jerome Powell and his central bank colleagues should take their cues from falling bond yields and lower short-term interest rates.” The yield on the 10-year Treasury, trading around 2.32% Tuesday morning, has dropped 10% from the beginning of the year. “The Fed has always followed interest rates [in the bond market] not led them,” says Laffer.

The 10-year yield fell below that of the 1-year for the second time this year. The so-called inverted yield curve has been a reliable sign of a recession if the move is sustained. Besides, why would anyone tie up their money for 10 years when the same rate of return could be had in just one year?

The market is telling the Fed there are legitimate fears of potential long-term economic trouble if the world economy doesn’t rebound and the tariff war turns into a full-blown global trade-war.

CONCLUSION

The Fed must lower short term rates at least one quarter point at its next meeting in June to prepare the U.S. economy for the possible storm ahead.

Powell Suggests Fed Could Cut Rates If Trade Spat Escalates: https://www.wsj.com/articles/powell-says-fed-is-closely-monitoring-trade-fight-escalation-11559656510?mod=hp_lead_pos1

Trump Wants to Cut Interest Rates. Powell Should Do It Anyway: https://www.wsj.com/articles/trump-wants-to-cut-interest-rates-powell-should-do-it-anyway-11559602689

Fed Would Consider Interest-Rate Cuts if Growth Outlook Darkens: https://www.wsj.com/articles/fed-would-consider-interest-rate-cuts-if-growth-outlook-darkens-11559231999?mod=hp_lead_pos1

High Interest Rates Are Hobbling Growth: https://www.wsj.com/articles/high-interest-rates-are-hobbling-growth-11559171116

Trump blames Fed once again for hurting economic growth: https://www.foxbusiness.com/politics/trump-fed-jerome-powellus-economic-growth-markets