WHO’S WINNING & LOSING? …

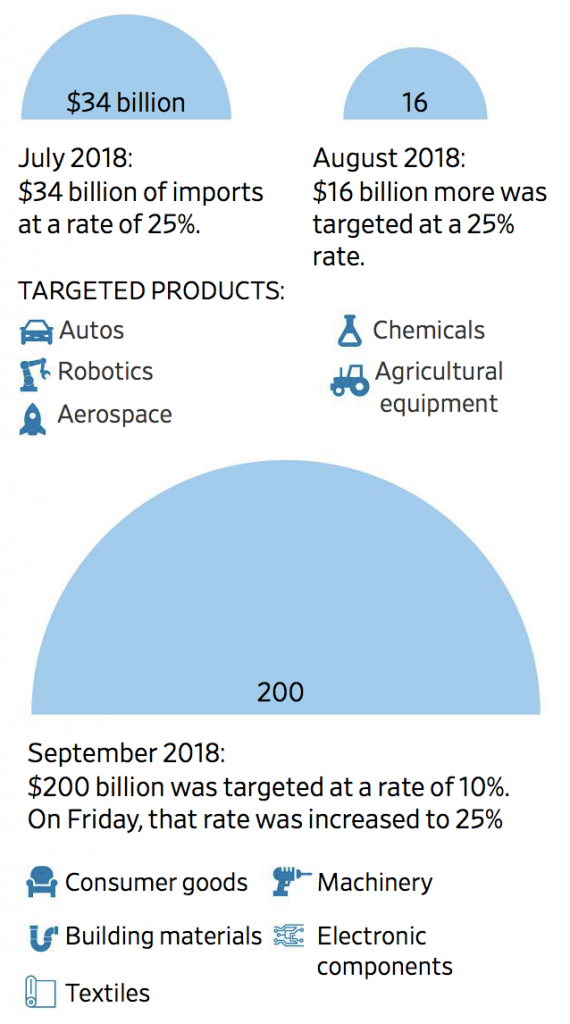

Since July-2018, the Trump Administration has been imposing tariffs on imports of Chinese goods to address a lopsided trade deficit, eliminate unfair trade practices, and obtain structural changes on trade issues that hurt U.S. economic security such as intellectual property, subsidies and forced technology transfer.

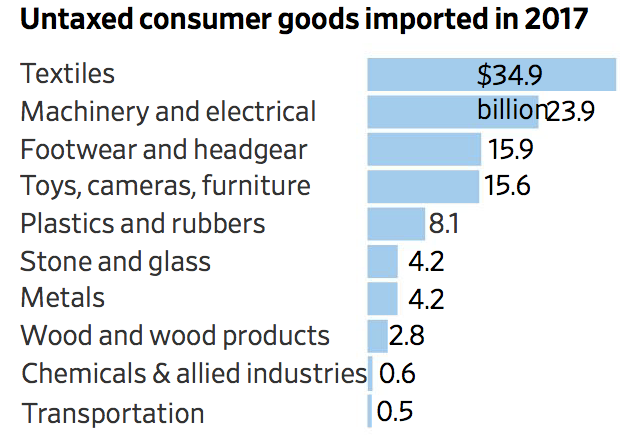

Recent trade talks between the U.S. and China trade delegations faltered when China reneged on structural changes they had agreed to previously. In response, Trump now plans to raise tariffs to 25% on the $200 billion of imports previously taxed at 10% and apply 25% tariffs to $300 billion worth of imports previously untaxed. Of those imports, ~40% are consumer goods.

President Trump refers to himself as “Tariff Man,” because he believes:

- China needs the U.S. as a trading partner much more than we need them, therefore, tariffs are an effective trade negotiation tool.

- The Chinese already had 25% tariffs on imported U.S. autos, whereas, the U.S. had only 2.5% tariffs on imported Chinese autos, so raising U.S. tariffs simply evens up the trading terms.

- China’s economy suffers when tariffs cause sales / exports to decline, manufacturers to leave the country, and jobs to disappear.

- U.S. businesses and consumers have been comparatively unaffected by Chinese tariffs on U.S. exports.

- Tariffs on imported goods bring in billions of dollars to U.S. coffers.

Let’s see if we can determine the validity of his arguments.

CHINA NEEDS THE U.S. MORE THAN WE NEED THEM

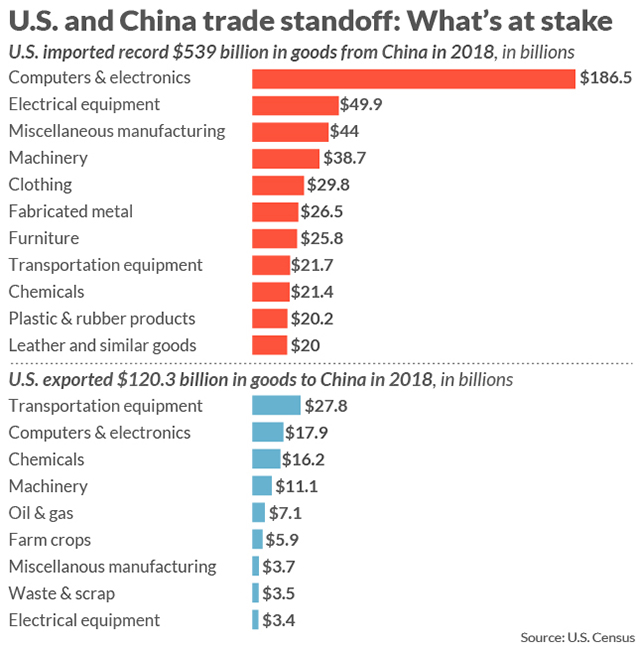

The chart below indicates that China exports 4.5 times more goods to the U.S. than vice versa, so China has much more to lose in a tariff war with the U.S.

And as CNBC’s Jim Cramer said on May 6: “At the end of the day, the People’s Republic needs our commerce a lot more than we need their commerce. The United States is a cash-fueled economy, the PRC is a debt-laden house of cards. They need our money, but do we really need their cheap stuff?”

So it stands to reason that Trump is correct — tariffs are a more effective tool for the U.S. than for China when negotiating a trade deal.

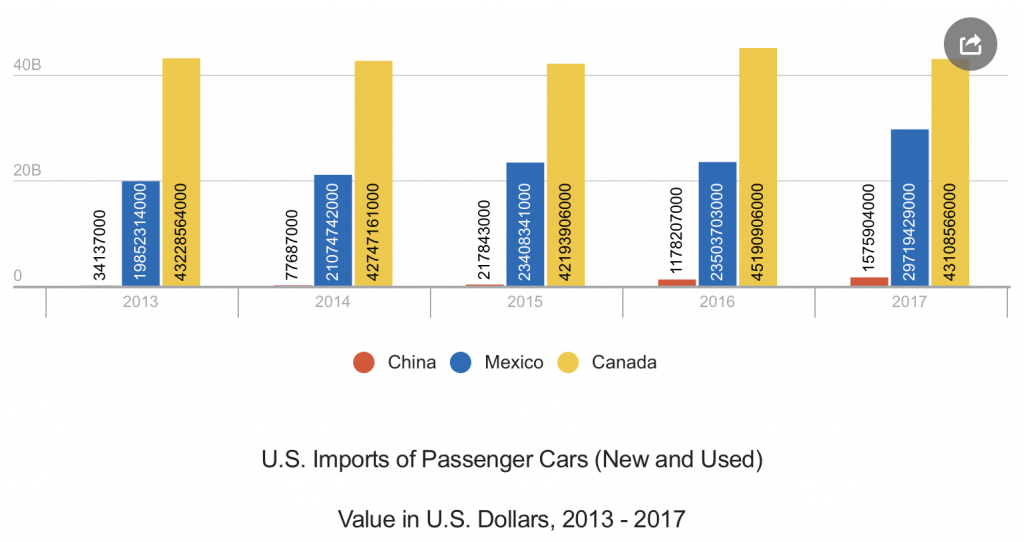

AUTO TARIFFS

Trump is technically correct — the U.S. does, in fact, pay a 25% tariff on cars sent to China, whereas China pays only 2.5% on cars coming into the United States. However, China exports only 3 out of every 10,000 cars sold in the U.S. And according to Gary Hufbauer from the Peterson Institute, “Chinese tariffs on American auto parts sent to China are well below 25%. That’s significant because U.S. firms often ship auto parts to China to be assembled there.”

TARIFFS ARE HURTING CHINA’S ECONOMY

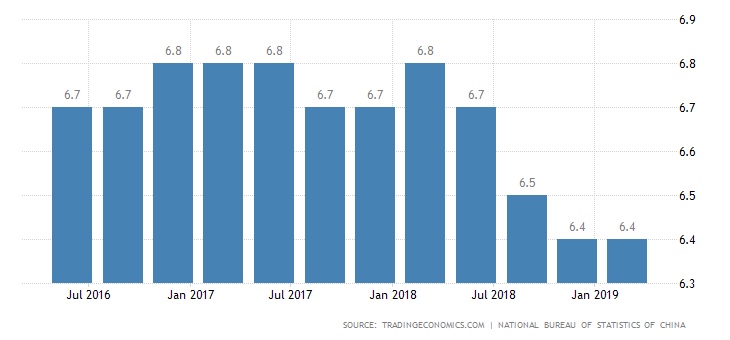

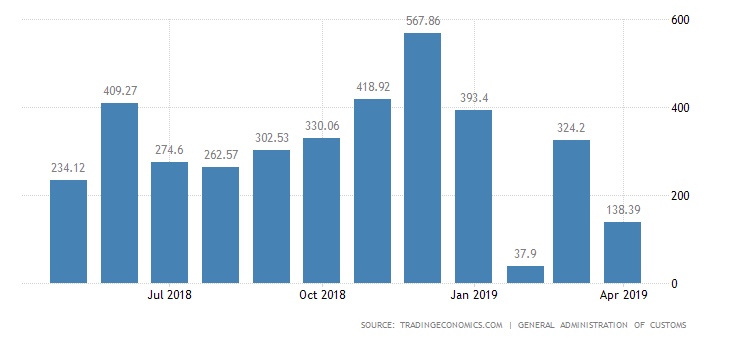

Here’s a look at China’s key economic indicators since Trump began levying tariffs on them in July 2018:

China’s GDP has been declining (and they overestimate annual growth by at least two percentage points) …

China’s trade surplus initially increased and peaked in December 2018, but has since been declining and recently plunged in February and April …

However, China’s unemployment rate has continually declined to a 15-year low in April …

Trump is mostly correct, as it appears that China’s economy has been struggling since the U.S. tariffs went into effect.

U.S. BUSINESSES AND CONSUMERS HAVE BEEN COMPARABLE UNAFFECTED

U.S. businesses can be affected by tariffs in two ways, depending on whether the business is exporting or importing.

On the export side …

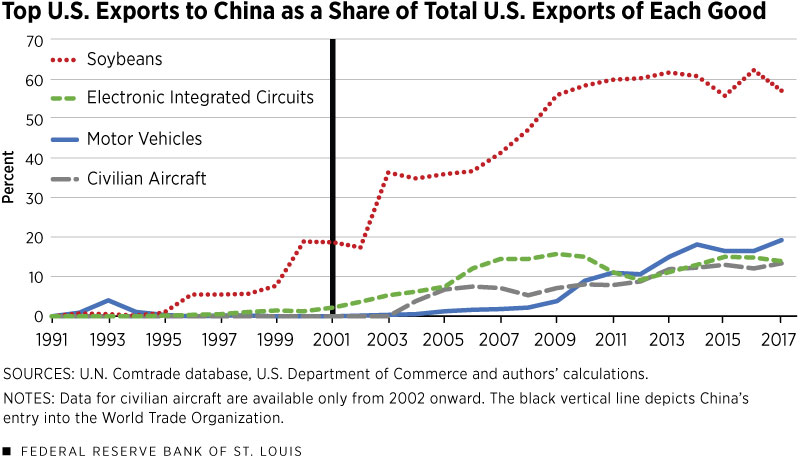

Major U.S. exports targeted by Chinese tariffs include soybeans and motor vehicles, parts and accessories. Therefore, two of the top four U.S. export categories to China are caught in this trade war … and commercial jets, airplane engines and other aviation equipment might also be included if China retaliates against Trump’s latest tariffs.

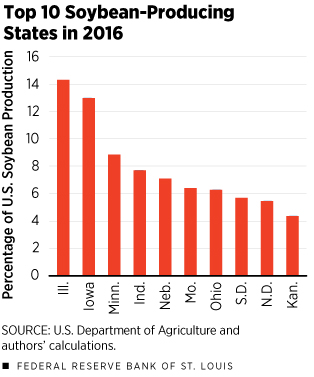

China’s retaliatory tariffs on $110 billion of the $120 billion total of U.S. exported goods were mostly targeted towards more than 800 U.S. food and agricultural products. As a result, according to the Congressional Research Service, U.S. food and agricultural exports to China in FY2018 amounted to $16.3 billion, a decline of about 25% from FY2017. The USDA projects that U.S. agricultural exports to China will fall to about $9 billion in FY2019 due to tariffs. U.S. soybean exports to China essentially dwindled to nothing after China imposed retaliatory tariffs. However, as a sign of goodwill in December 2018, China purchased over 1.1 million metric tons of U.S. soybeans. The Trump Administration, through USDA, is trying to mitigate these adverse impacts of the trade dispute with China by providing $12 billion in financial assistance to affected farmers and ranchers. Those affected are primarily located in 10 mid-western states.

On the import side …

Importing companies are the entities who actually pay tariffs. As explained in a Reuters article, an importing company paying tariffs can manage the cost in various ways:

1. Pay the full cost and live with a lower profit margin.

2. Cut costs to offset higher tariffs.

3. Ask suppliers in China for a discount to help offset the higher tariffs.

4. Seek to source supplies from outside China, which results in some Chinese companies losing business.

5. Pass the tariff costs on to customers by increasing retail prices.

Most importers use a mix of those options to spread the cost between suppliers, themselves, and consumers or buyers.

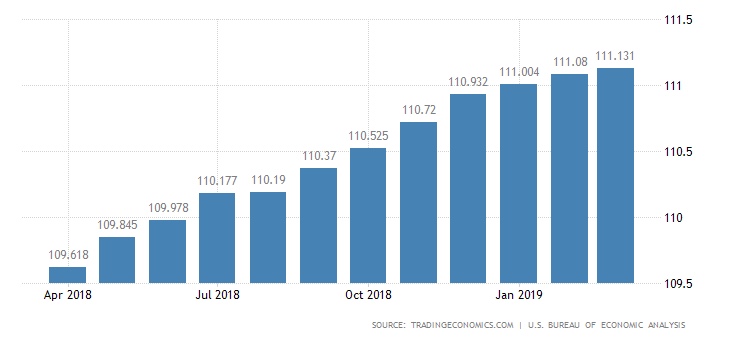

U.S. businesses affected by higher input costs for metal commodities and auto parts have sought out alternative suppliers in countries unaffected by tariffs and/or absorbed the higher costs. Trump’s corporate tax and regulation cuts lowered business costs, allowing importers to absorb tariffs rather than passing the cost along to consumers via higher prices. Thus far, U.S. consumers have benefited. As we can see from the chart below, the Federal Reserve Bank’s preferred measure of inflation — U.S. core personal consumption expenditures (PCE) price index — has gone up from March-2018 to March-2019 by only 1.6%, compared with the Fed’s target of 2%.

Trump is correct, for the moment, as U.S. businesses have managed to avoid and absorb the current Chinese tariffs, and U.S. consumers haven’t experienced abnormally higher prices. But it may be more difficult to accomplish this Goldilocks scenario in the future, depending on the type and level of new tariffs levied in retaliation by the Chinese.

TARIFFS BRING IN BILLIONS OF DOLLARS TO U.S. COFFERS

As of mid-March, the U.S. has netted $15.6 billion through tariffs imposed since February 2018, according to data from U.S. Customs and Border Protection (CBP). Customs duties receipts in the first half of the current 2019 fiscal year, which began on Oct. 1, have shot up by 89% from a year ago to $34.7 billion, data from U.S. Treasury shows.

Chinese tariff revenue in 2018 was $42.41 billion, down from $44.65 billion in 2017.

While Trump’s claim that China is paying billions of dollars of tariffs to the U.S. is false (importers pay), the U.S. is benefitting from a substantial surplus of new import duties.

CONCLUSION

Our cost / benefit analysis supports the United States’ tariff posture. Current tariffs have been more impactful on the Chinese economy and succeeded in bringing China to the negotiating table. An escalation of U.S. tariffs will likely result in minor short-term costs to American GDP, businesses and consumers, but they’ll cause a major decline in China’s manufacturing base. In the long run, China will have to choose between dire economic consequences or making structural changes in its trading behavior … changes compatible with the fair trade commitments that China made when it joined the World Trade Organization in December 2001. If China makes the right choice, all the world’s market economies will benefit greatly … and history will judge Trump’s tariffs kindly.