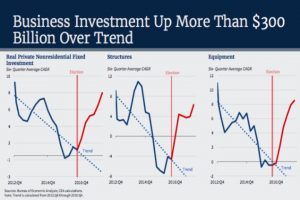

On September 10th, White House economic advisor Kevin Hassett presented multiple charts to highlight America’s economic turnaround that started immediately after President Trump was inaugurated and, according to Associated Press, “to rebut President Obama’s point that his policies helped end the Great Recession and put the economy on a growth path that Trump is now mostly benefiting from.”

During Hassett’s candid and informative presentation in the White House Briefing Room, he said: “Companies are much more optimistic and have increased spending on buildings and equipment. Americans are starting new businesses and the increase in startups is accelerating more quickly than it did under Obama, he added, and blue-collar jobs — in mining, construction and manufacturing — are growing more rapidly. And I think that if anyone were to assert that the capital spending boom that we’re seeing right now was a continuation of the trend that President Trump inherited, then, well, they wouldn’t get a high grade in graduate school for that assertion.”

Of course, next came the biased media’s fact checking …

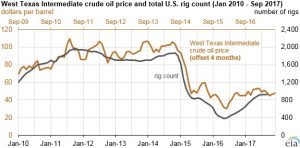

AP FACT CHECK: It’s true that companies are investing much more in buildings, computers and other capital goods than they were in the last two years of the Obama administration. And some of that additional investment may have been spurred by the Trump administration’s corporate tax cut. But another reason for the revitalization of business spending has been a turnaround in oil prices. Oil prices plunged in 2014 and 2015 from over $100 a barrel to roughly $30 a barrel in early 2016. They have since doubled to $67 a barrel. Those swings alternatively dampened investment in drilling rigs and other heavy machinery and helped send that spending higher. Oil- and gas-related investment accounted for about 40 percent of the growth in business investment in the April-June quarter this year.

SLATE MAGAZINE FACT CHECK: The investment growth rate initially rose during Obama’s first term, then declined, before starting to recover in the middle of 2016, before Trump’s election. The pace of investment has continued to pick up under Trump, but the timing and shape of the previous trend are entirely different. That’s important, because much of the investment crash under Obama was driven by a collapse in oil prices, which ground drilling to a halt in places like Texas and North Dakota. After crude began to recover in 2016 and 2017, so did the number of oil rigs, which helped prop up business investment. Oil hasn’t been the only factor driving investment figures—but it’s an important one that has little to do with Obama’s or Trump’s policies.

It’s not surprising that the media focuses their counterargument on the oil industry — which accounts for 40% of the growth in business investment — and ignores the lion share of the growth, but just for fun we’ll play their game.

We’ll also concede that oil rig count does correlate with oil pricing, as the chart below indicates, thus setting the stage for commensurate rising prices and investment.